Individuals with bad credit can access emergency funding through a title loan secured by their paid-off car, offering quicker approval times and alternative financing without relying on traditional credit checks. However, these loans carry risks like repossession and higher interest rates, with limited repayment flexibility.

Looking to access cash despite bad credit? A title loan on your paid-off car could be an option. This article demystifies this alternative financing method, focusing on understanding title loans, eligibility criteria for borrowers with poor credit, and the benefits—and potential risks—of using your paid-off vehicle as collateral. By exploring these aspects, you’ll gain valuable insights into whether a title loan is right for you.

- Understanding Title Loans: An Overview

- Eligibility Criteria for Bad Credit Borrowers

- Benefits and Potential Risks of Paid-Off Car Titles

Understanding Title Loans: An Overview

A Title Loan on a Paid Off Car with Bad Credit? It’s Possible!

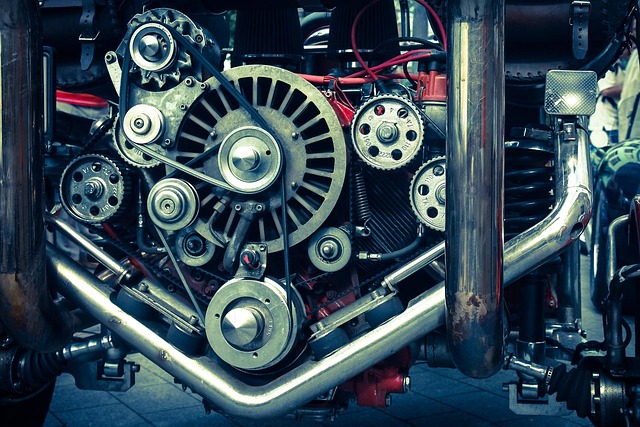

Title loans have emerged as an attractive option for individuals seeking quick financial support, especially those with less-than-perfect credit scores. Unlike traditional loans that rely heavily on your credit history, a title loan uses the equity in your vehicle—specifically, its title—as collateral. This means even if you’ve had challenges maintaining good credit, you can still access funds by pledging the ownership rights to your paid-off car. The process is straightforward and often involves quicker approval times compared to conventional loans.

The beauty of a title loan lies in its accessibility. It’s not uncommon for people with bad credit to find it difficult to secure loans from banks or other lenders. However, with a title loan, the focus shifts to the value of your vehicle during the vehicle valuation process. This innovative approach ensures that individuals can still gain access to much-needed funds when traditional avenues might be blocked due to poor credit ratings.

Eligibility Criteria for Bad Credit Borrowers

For borrowers with bad credit seeking emergency funding, a title loan on a paid-off car can be an option to explore. While traditional loans may be out of reach due to low credit scores or a history of missed payments, this alternative financing method offers a chance for those in desperate need of cash. Lenders typically require the vehicle as collateral, ensuring a secure transaction.

Eligibility criteria for bad credit borrowers with this type of loan often include owning a paid-off car, having a clear title, and providing proof of income. The focus is on the value of the vehicle and the borrower’s ability to repay, rather than strict credit checks. This makes it an attractive solution for those in need of quick cash, especially when considering loan refinancing options.

Benefits and Potential Risks of Paid-Off Car Titles

Using your paid-off car as collateral for a title loan can offer several advantages when dealing with bad credit or limited financial options. One significant benefit is that it provides an alternative to traditional loans, where strict credit requirements often hinder individuals with low credit scores. With a title loan, you retain ownership of your vehicle while accessing liquidity, which can be particularly useful for unexpected expenses or debt consolidation. It’s an opportunity for folks looking to improve their financial standing by providing a safety net during challenging times.

However, as with any loan, there are potential risks involved. The primary concern is the security aspect; if you default on repayments, the lender has the right to repossess your vehicle. Additionally, these loans often come with higher interest rates compared to conventional options due to the increased risk for lenders. Repayment options can be less flexible, and a thorough credit check is typically required before approval, which might be a challenge for those seeking to improve their credit score.

A title loan on a paid-off car can offer an alternative financing option for individuals with bad credit. By utilizing their vehicle’s equity, borrowers can access funds without strict credit checks. However, it’s crucial to be aware of the potential risks, including high-interest rates and the possibility of losing one’s vehicle if unable to repay. Understanding both the benefits and drawbacks is essential before pursuing this option for short-term financial needs.