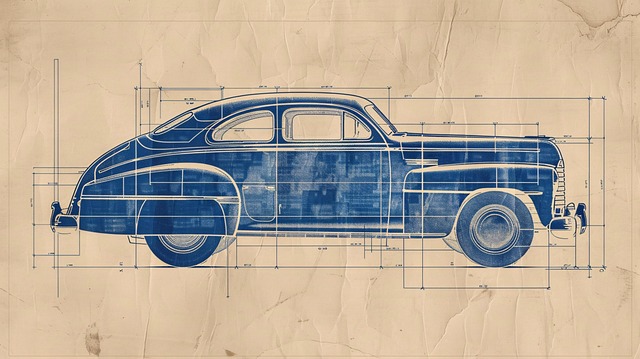

A title loan on a paid-off car offers bad credit borrowers quick cash using vehicle equity, bypassing traditional credit checks. After providing title, proof of ownership, and ID, funds are accessed immediately. Repayment allows for title return, but understanding higher interest rates and potential risks is crucial to avoid default or repossession.

Looking to access cash despite a poor credit score? Consider a title loan on your paid-off car. This option allows you to leverage your vehicle’s value, offering a solution for urgent financial needs. In this guide, we’ll explore the intricacies of title loans and how a paid-off car can serve as collateral. We break down ‘Understanding Title Loans’ and offer insights into ‘Navigating Bad Credit,’ providing borrowers with a comprehensive overview of their alternatives and considerations.

- Understanding Title Loans: An Overview for Borrowers

- Paid-Off Cars and Their Role in Securing Loans

- Navigating Bad Credit: Options and Considerations

Understanding Title Loans: An Overview for Borrowers

A Title Loan on a Paid Off Car with Bad Credit is an option for borrowers seeking quick cash. This type of loan uses the car’s title as collateral, allowing individuals to access funds even with less-than-perfect credit scores. It’s important to understand how this process works before applying.

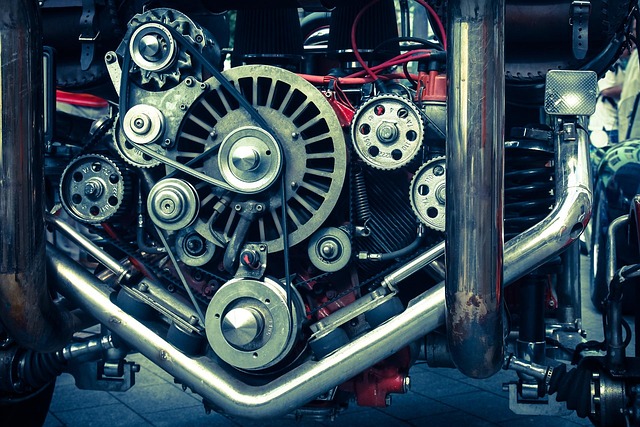

When considering a Title Loan on a Paid Off Car, lenders will assess your vehicle’s value and your ability to repay. The loan requirements typically involve providing the car’s title, proof of ownership, and identification. Unlike traditional loans, a bad credit score doesn’t automatically disqualify you. Lenders focus more on the equity in your vehicle than your credit history, making it possible for those with lower credit ratings to gain access to immediate cash through a cash advance secured by the car’s title. Once approved, a title transfer is initiated, and upon repayment, the title is returned to the borrower.

Paid-Off Cars and Their Role in Securing Loans

When considering a title loan on a paid-off car, it’s important to understand the unique role these vehicles play in securing loans for individuals with bad credit. A paid-off car serves as collateral, offering lenders a tangible asset to mitigate risk. This is particularly beneficial for those who may not qualify for traditional loans based on their credit history. By using the vehicle as security, lenders can provide access to much-needed funds while also ensuring they have a legal right to repossess the car in case of default.

The title loan process begins with an online application where borrowers provide details about their paid-off car, including make, model, and year. This information is crucial for assessing the vehicle’s value and determining the loan amount. San Antonio loans, for instance, have gained popularity due to this accessible and alternative financing option, catering to a diverse range of borrowers. Once approved, the lender will issue the loan, allowing individuals to access funds quickly, making it an attractive solution for short-term financial needs.

Navigating Bad Credit: Options and Considerations

For individuals with bad credit, securing a loan can be a challenging task, but there are options available, especially when considering a title loan on a paid-off car. This alternative financing method offers flexibility and accessibility for those who own their vehicles outright. One of the main benefits is that it doesn’t typically require a credit check, making it an attractive solution for people with poor credit histories.

When exploring this option, it’s crucial to understand the process and associated interest rates. A Houston title loan, for instance, involves using your vehicle’s title as collateral, ensuring the lender has security. However, borrowers should be mindful of potential risks, such as higher interest rates compared to traditional loans. It’s essential to shop around, compare offers, and ensure you can comfortably repay the loan within the agreed-upon terms to avoid default or repossession.

A title loan on a paid-off car can be an option for individuals with bad credit seeking quick funding. By using the vehicle’s title as collateral, borrowers can access short-term loans without strict credit checks. This alternative financing method allows owners of paid-off vehicles to leverage their asset’s value, providing a potential solution for emergency expenses or debt consolidation. However, it’s crucial to understand the terms and conditions thoroughly before agreeing to any loan agreement.