Title loans on paid-off cars offer quick cash, with approvals often faster than traditional bank loans in Houston and Dallas. However, borrowers face risks like high interest rates and repossession if payments are missed. Understanding tailored payment plans is crucial. Defaulting can lead to severe consequences, including vehicle repossession; open communication with lenders can help manage defaults and improve future financial access.

A title loan on a paid-off car might seem like a quick cash solution, but defaulting on such loans can have severe consequences. This article delves into the intricacies of this practice, starting with an understanding of title loans and their application to already repaid vehicles. We then explore the potential pitfalls, including repossession and legal actions, when borrowers fail to meet repayment obligations. Finally, we offer resolutions and options for those facing default, providing guidance on how to navigate these challenging situations.

- Understanding Title Loans and Paid-Off Cars

- Consequences of Default on a Title Loan

- Options and Resolutions After Car Title Loan Default

Understanding Title Loans and Paid-Off Cars

Title loans on paid-off cars are a type of secured lending that allows vehicle owners to use their car’s title as collateral for a short-term loan. This option is particularly popular among those in need of quick cash, as it offers faster approval compared to traditional bank loans. In many cases, individuals can access substantial funds by using their paid-off vehicle, providing an opportunity to cover unexpected expenses or seize business opportunities.

In Houston and Dallas, where the demand for Title Loans is high, lenders typically assess the car’s value and offer a percentage of its equity as a loan. Unlike traditional loans that require credit checks, these loans focus primarily on the vehicle’s title and condition. While it can be an attractive option for immediate financial relief, borrowers should be mindful of the associated risks, including interest rates and potential repossession if payments are missed. Understanding the terms, including payment plans tailored to their needs, is crucial before taking out a Title Loan on a paid-off vehicle.

Consequences of Default on a Title Loan

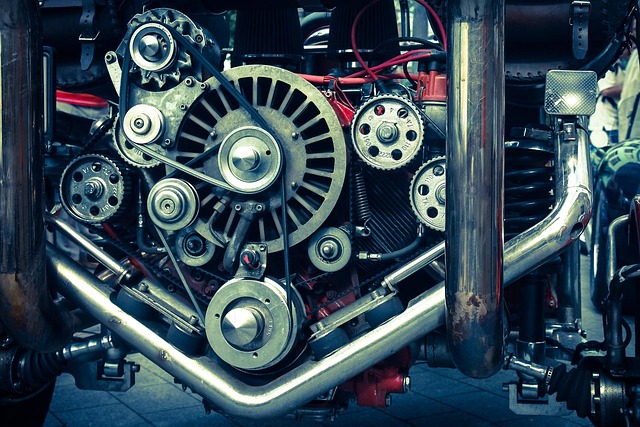

When a borrower defaults on a Title Loan for a paid-off car, the consequences can be severe. Lenders have legal recourse to repossess the vehicle, which can lead to financial strain and potential loss for the owner. The process often begins with a written notice of default, providing the borrower with a specified period to resolve the issue or face repossession. During this time, borrowers should consider negotiating with the lender or exploring options for repayment to avert further action.

In the event of default, lenders typically conduct a vehicle inspection to assess its condition and value. This step is crucial in determining the next course of action, which could include selling the car at a discounted price to cover the outstanding loan balance. It’s important for borrowers to understand their Loan Terms and communicate openly with lenders to manage any financial challenges that may lead to default. Having emergency funds readily available can also help navigate such situations more smoothly.

Options and Resolutions After Car Title Loan Default

After defaulting on a title loan for a paid-off car, borrowers often find themselves facing several options and resolutions. The first step is to communicate with the lender openly and transparently. Lenders typically have provisions for repayment plans tailored to help borrowers catch up on their payments without repossessing the vehicle. These payment plans are designed to be flexible, taking into account individual financial situations, often involving reduced monthly installments or extended terms.

For those who might be concerned about their credit score, it’s important to understand that defaulting on a title loan doesn’t automatically lead to severe long-term consequences. While a default will appear on your credit report, it may not impact your credit score as dramatically as other types of defaults. However, the absence of a credit check during the initial loan process can also work against you if you need to take advantage of financial services in the future, as lenders might be more cautious when considering new loans or lines of credit.

When you take out a title loan on a paid-off car, defaulting can have severe consequences. This article has explored the process and outlined options for resolution, emphasizing the importance of understanding these risks before entering into such agreements. Remember that proactive communication with lenders is key to avoiding default and its associated financial setbacks.